ratings-display.rating-aria-label(1)

Mar 45 min read

269

1

Dec 13, 20243 min read

142

0

ratings-display.rating-aria-label(3)

Nov 30, 20244 min read

271

3

ratings-display.rating-aria-label(1)

Nov 22, 20243 min read

162

1

Hello everyone,

Have you been watching the markets lately?

If you have, why? … have I not told you before to stop looking at them!

All jokes aside, it’s been almost impossible to not have watched or seen the very strange political goings on at the moment, and with it catch a glimpse of the sensationalist headlines around the short term and temporary stock market declines.

Listen… I have read every book on the subject, I should know how to behave in times like this, but I’m only human! I’ve found myself getting sucked and drawn into some of this nonsense, questioning (only a tiny bit!) if this time may be different.

The good news is I’ve managed to regain my sanity and remind myself, and more importantly through this email remind you, that this is completely normal!

As much as I’m writing this for you, it’s also providing me with some much need self-therapy… So, Dearest Gentle Reader, let’s take a deep breath and look at the bigger picture.

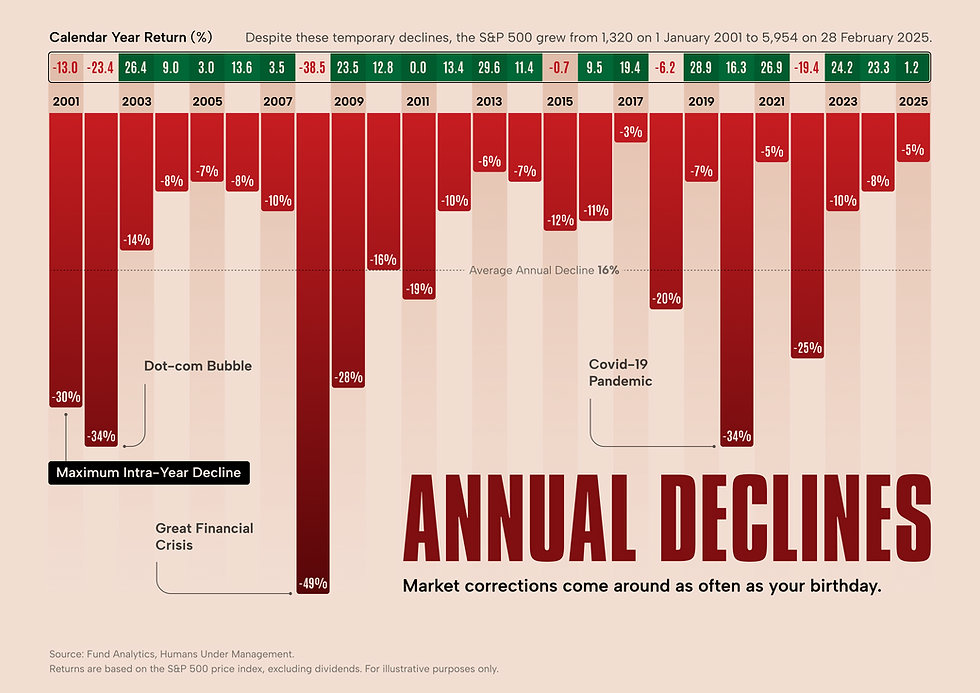

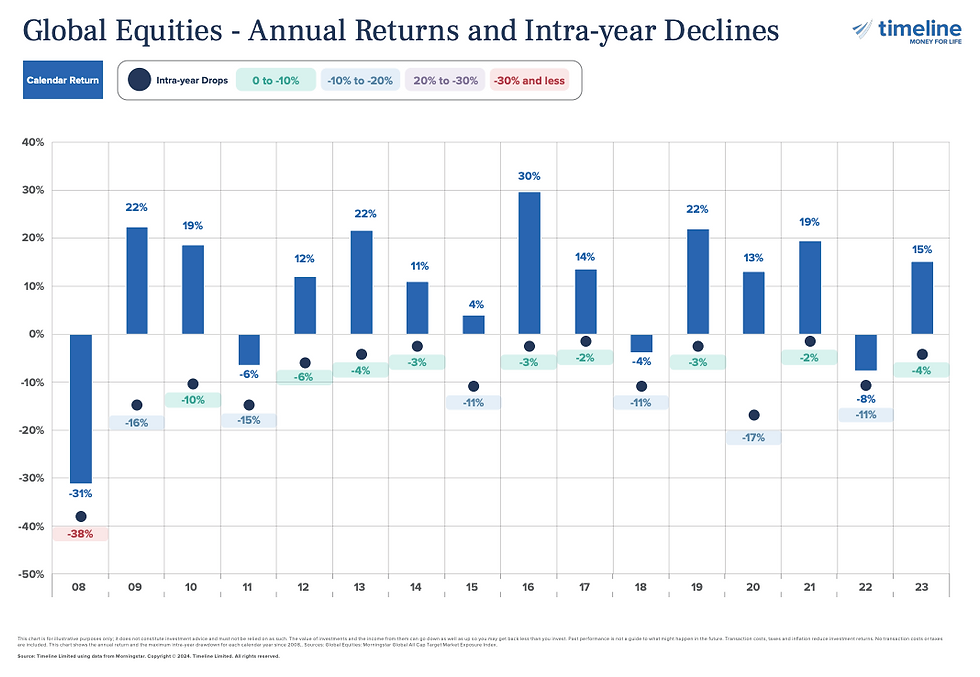

Market dips are not just common; they’re part of the deal. Historically, the UK stock market, much like its US counterpart, sees an intra-year drop of around 10-15% on average.

But, and this is the important bit, it still tends to finish the year in positive territory more often than not.

Think of it like the British weather: it might chuck it down with rain in the morning, but by the afternoon, the sun is peeking through, and you’re regretting that extra layer.

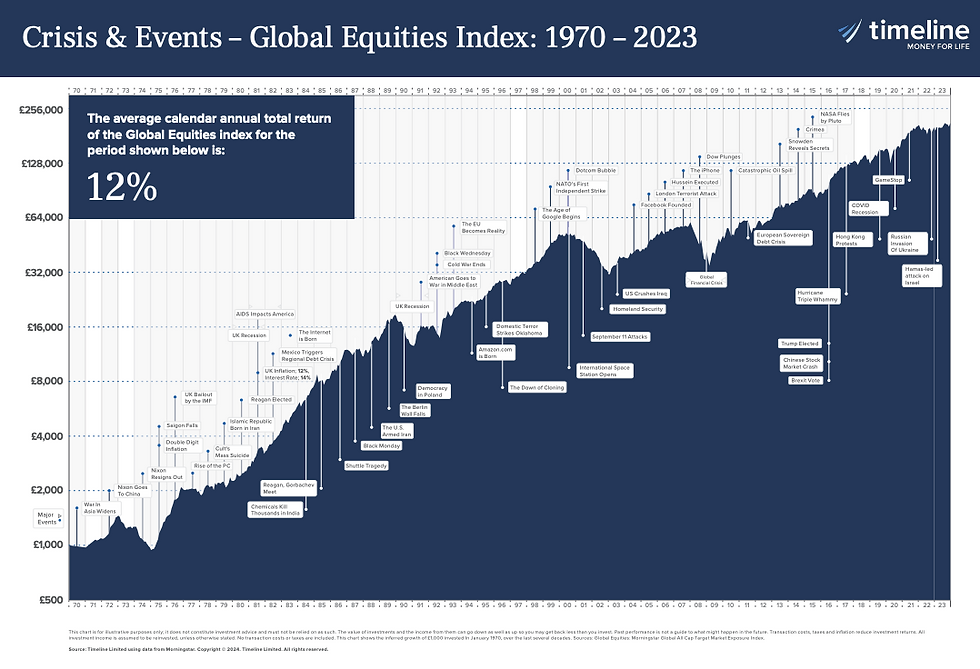

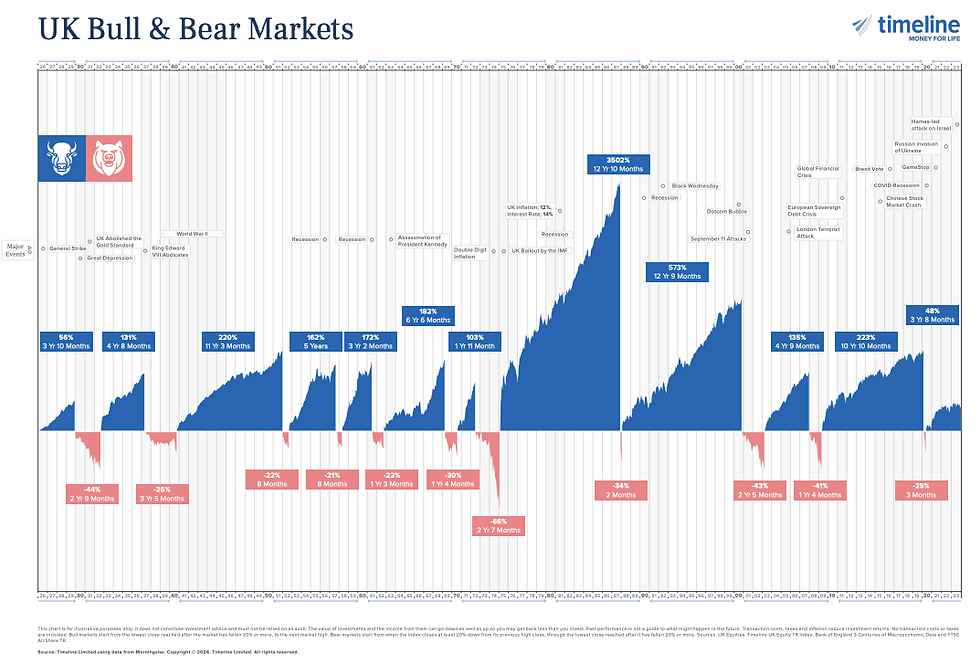

The markets are no different. They have their ups and downs, but over the long term, they trend upwards.

When markets wobble, the knee-jerk reaction might be to ‘do something’.

But history shows that people who make emotional (some may say rash) decisions, like selling everything at the first sign of trouble, often regret it later.

Missing just a few of the market’s best days (which, frustratingly, tend to come right after the worst ones) can seriously dent your long-term returns.

So, instead of panic-selling, here’s what we do instead:

1. Stick to the Plan

You have a well-researched, robust and evidence-based strategy in place for a reason.

You are more than likely planning for retirement or fully enjoying your second half of life. A short-term wobble doesn’t change the bigger picture.

2. Turn Off the Noise

Financial news thrives on drama. Headlines like “Stock Market in Freefall!” or “Investors Lose Billions in a Day!” are designed to make you click (or worse, panic).

But if you zoom out, these daily swings are just tiny blips on a much bigger timeline.

3. Remember: Time in the Market Beats Timing the Market

Trying to predict when it is the best time to jump in and out of the market is like trying to guess the winning lottery numbers, almost impossible and very lucky if you get it right.

History shows that staying invested, even though turbulent times, is the best way to grow and protect wealth over the long term.

4. Diversify, Diversify, Diversify

A well-balanced portfolio, spread across different asset types and regions helps cushion the blows.

If one area takes a hit, another may well be doing just fine.

5. Keep Cash for Emergencies

If you’ve got a solid emergency fund tucked away, you won’t need to dip into your investments when markets are down, and your investments have declined to a level that means continuing to draw income may challenge your plans sustainability.

You will have the ability and financial resources to ride out the storm without worry.

Final Thought: It’s Not About the Short-Term

Investing, even in your retirements is a long game.

If we look back 20, 30, or even 50 years, every market dip has been followed by a recovery.

Staying the course and focusing on your long-term goals is what truly pays off.

So, next time the markets take a tumble, take a deep breath, make a cup of tea (or in my case a strong flat white!), and remember that this is all part of the journey.

If you have any concerns, I’m always here for a chat!

Stay strong, stay invested, stay the course and most importantly… stay off the financial news channels!

.png)

Kommentare